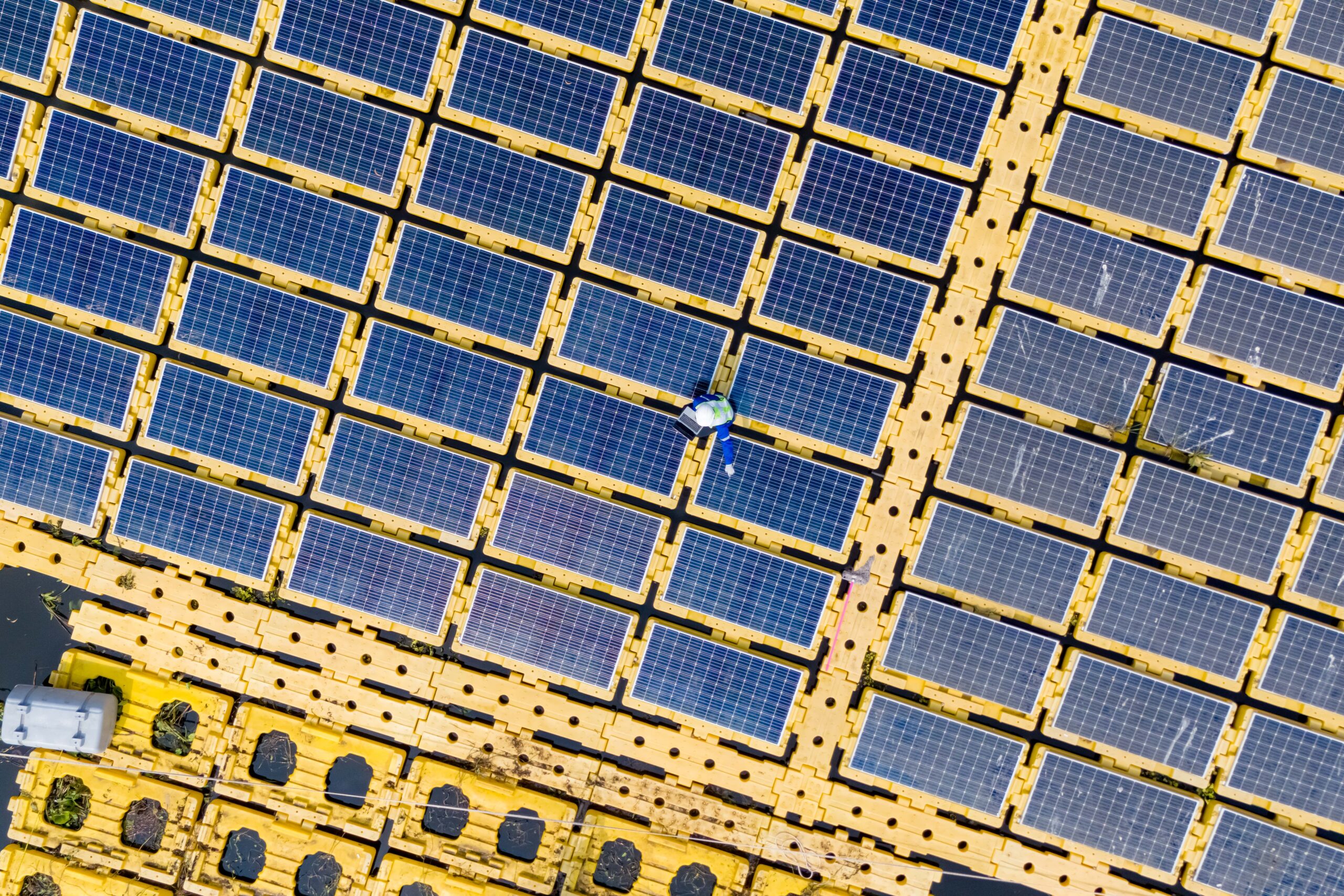

Have you ever wondered if solar panels are expensive? Well, you’re not alone! Many homeowners perceive solar panels come with a hefty price tag. However, the reality might surprise you. Over the past decade, there has been a significant drop in solar panel costs, making them more affordable and accessible than ever before. In this article, we’ll explore the actual cost of solar panels and debunk the common misconceptions. Get ready to discover how solar power can be a viable and cost-effective option for homeowners like yourself. Let’s dive in!

Current Cost Trends

In 2010, the average cost of installing a solar panel system for a home was relatively high compared to what we saw in 2024. Over the years, advancements in technology and increased adoption of solar energy have led to significant cost reductions. On average, the cost of residential solar panel systems has dropped by around 70% since 2010. Isn’t that amazing?

Now, let’s talk about the financial incentives that can further reduce the cost of going solar. The federal government offers a solar Investment Tax Credit (ITC), which allows homeowners to claim a percentage of their solar installation costs as a tax credit. Currently, the ITC offers a 26% credit for eligible residential solar installations. If your solar panel system costs $20,000, you could receive a tax credit of $5,200. That’s a substantial cost reduction!

Additionally, many provinces provide incentives to encourage solar adoption. These can include rebates, grants, and performance-based incentives. The availability and specifics of these incentives vary by province, so it is worth exploring what incentives are offered in your area.

By taking advantage of federal tax credits and state incentives, homeowners can significantly lower the upfront cost of installing a solar panel system. This makes solar energy a more affordable and attractive option for many.

Rising Electricity Costs

There has been a noticeable increase in average electric bills from 2010 to recent years. According to data, Canada’s average residential electricity rate has risen by approximately 13% during this period. This means that homeowners are paying more for their electricity consumption compared to a decade ago.

Rising electricity prices can have a significant financial impact on homeowners. As electricity costs increase, they directly affect monthly utility bills, straining household budgets. Higher electric bills can eat into disposable income and limit the ability to save or invest in other areas.

However, there’s a silver lining! By transitioning to solar energy, homeowners can mitigate the economic effect of rising electricity prices. Solar panels generate clean and renewable energy, reducing reliance on traditional grid electricity. This can lead to substantial savings on electric bills over time.

By installing a solar panel system, homeowners can generate electricity and potentially offset a significant portion of their energy consumption. This means less exposure to rising electricity prices. Plus, with federal tax credits and state incentives, the upfront cost of going solar can be further reduced, making it a financially wise choice.

Rising electricity costs can indeed have an economic effect on homeowners, but going solar offers a solution to combat these increasing expenses. It’s a win-win situation for your wallet and the environment!

Investment Perspective

Solar panels are a sustainable energy solution and a smart investment that pays off over time. They allow homeowners to generate electricity, reducing reliance on the traditional grid. Producing your own clean energy can significantly lower your monthly electric bills. Over time, these energy savings can add up and help recoup the initial investment in solar panels.

But that’s not all! The financial incentives available for solar installations make it even more attractive. The federal government offers the Investment Tax Credit (ITC), which allows homeowners to claim a percentage of their solar installation costs as a tax credit. Currently, the ITC offers a 26% credit for eligible residential solar installations. This means that a portion of your investment can be offset through tax savings.

Additionally, many provinces provide incentives, such as rebates and grants, to reduce the cost of going solar. These incentives vary by location, so exploring what’s available in your area is worth exploring.

If the cost of solar panels is a concern, financing options are also available. Some solar companies offer financing programs allowing homeowners to install solar panels with minimal upfront costs. These programs often include attractive interest rates and flexible payment terms, making solar more accessible and affordable.

So, when you consider energy savings, tax credits, rebates, and financing options, solar panels become a wise investment that helps you save money and contributes to a greener and more sustainable future.

Case Studies or Examples

The Smith family, residing in a suburban area, decided to invest in solar panels for their home in 2018. Initially concerned about the upfront cost, they were pleasantly surprised by the financial rewards over time.

With a 5-kilowatt solar panel system installed, they saw an immediate reduction in their monthly electricity bills by approximately 30%. This translated to savings of around $1,200 per year. Moreover, the federal tax credit and local incentives lowered their initial investment, making the decision even more cost-effective.

Today, Dustin enjoys not only reduced energy costs but also the satisfaction of contributing to a cleaner environment.

Another example is Carly B, a homeowner in Canada. She invested in solar panels for her home and took advantage of the state’s generous solar incentives. With the combination of the federal tax credit, state rebates, and net metering, Sarah was able to reduce her electricity bills significantly.

Not only did Sarah save money on her monthly energy expenses, but she also became eligible for Solar Renewable Energy Credits (SRECs). These credits allowed her to earn additional income by selling the excess energy her solar panels generated back to the grid.

Over time, Sarah’s solar panels paid for themselves, and she continued to enjoy the financial benefits of clean, renewable energy. Her investment in solar made economic sense and aligned with her commitment to sustainability.

Matthew B, a homeowner in a rural area, was initially hesitant about installing solar panels due to cost concerns. However, after thorough research and consultation with solar experts, he decided to invest. With a 12-kilowatt solar panel system installed, Mark saw a noticeable decrease in his monthly energy bills, saving around $2,000 annually. The combination of federal tax incentives and local rebates significantly offset the initial cost, making solar panels a financially sound decision for Mark. He now recommends solar energy to friends and family as an innovative and eco-friendly choice.

Considerations and Calculations

To calculate the ROI for solar panels, you can consider the following factors:

1. Initial Cost: Determine the total cost of purchasing and installing the solar panels.

2. Energy Savings: Estimate the monthly money saved on electricity bills after installing solar panels.

3. Incentives: Consider any tax credits, rebates, or incentives available for solar installations.

4. Financing: Consider the financing options, such as loans or leasing, and factor in associated costs.

5. System Lifespan: Assess the expected lifespan of the solar panels and their degradation rate over time.

By comparing the initial cost with the energy savings, incentives, financing, and system lifespan, homeowners can calculate the approximate payback period and overall ROI for their solar panel investment.

Now, let’s address common concerns about maintenance costs and long-term savings. Solar panels generally require minimal maintenance, with occasional cleaning and inspections to ensure optimal performance. While there may be some maintenance costs over the years, they are typically outweighed by the long-term savings on electricity bills.

In terms of long-term savings, solar panels have a lifespan of around 25 to 30 years, during which homeowners can enjoy significant energy savings. Additionally, as electricity prices continue to rise, the savings from solar panels become even more valuable over time.

It’s important to note that the specific ROI, maintenance costs, and long-term savings will vary depending on location, energy usage, and solar installation size. Consulting with a solar professional or online solar calculators can provide more accurate estimations based on individual circumstances.

Solar panels are becoming more affordable and highly cost-effective in the long run. With advancements in technology and decreased production costs, you can save money on your electricity bills while positively impacting the environment. Plus, federal tax credits and state incentives can further reduce the upfront cost, making solar panels an even smarter investment.

Installing solar panels is worth considering if you want to cut down on your energy expenses, contribute to a greener future, and take advantage of available incentives. Harness the sun’s power and enjoy long-term financial benefits.