Energy upgrades are crucial in enhancing homes by improving energy efficiency, reducing utility costs, and minimizing environmental impact. This article will delve into the world of PACE programs and how they provide an innovative solution for financing energy upgrades. PACE, which stands forl Property Assessed Clean Energy, allows homeowners to fund these upgrades through property tax assessments. It’s an exciting avenue that benefits homeowners and promotes sustainable living and a greener future. Let’s dive in and unlock the potential of home energy upgrades with PACE programs!

Understanding PACE Programs

PACE, which stands for Property Assessed Clean Energy, is a financing mechanism that enables property owners to fund energy efficiency, renewable energy, and water conservation improvements. It allows homeowners to make these upgrades without needing upfront payment, instead financing them through a special assessment of their property taxes.

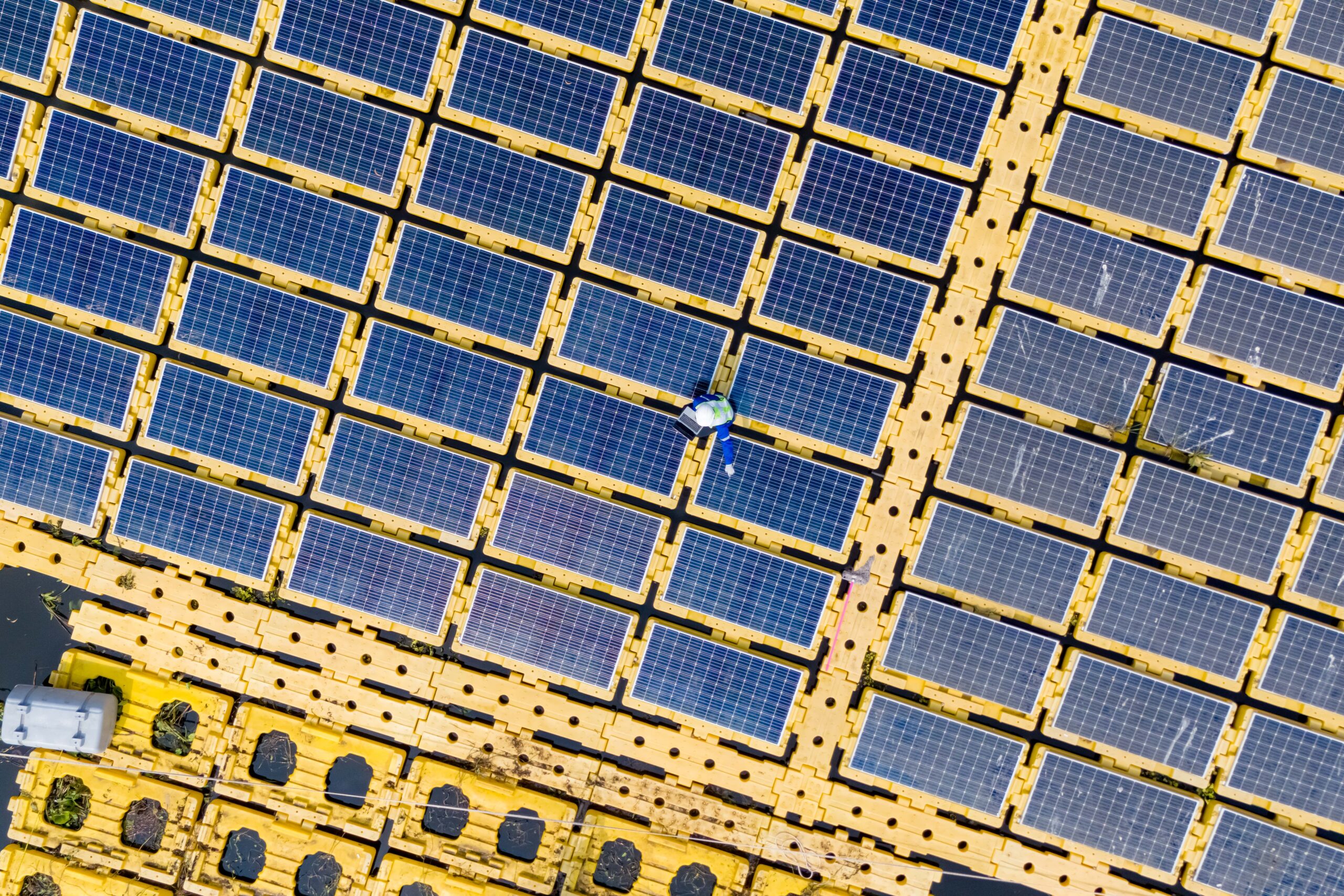

PACE programs work by partnering with local governments and private capital providers. The program provides financing for eligible improvements, such as solar panel installations, HVAC upgrades, insulation, etc. The financed amount is then repaid over a long-term period through a property tax assessment, which is added to the property owner’s tax bill.

The primary objectives of PACE programs are to promote energy efficiency, reduce greenhouse gas emissions, stimulate economic growth, and create jobs. By providing accessible financing options, PACE programs empower homeowners to invest in sustainable upgrades that benefit their wallets and the environment.

To participate in PACE programs, homeowners must meet specific eligibility criteria. These criteria may vary depending on the program and location but generally include property type (residential, commercial, industrial), property ownership, and compliance with local regulations.

Researching and consulting with local PACE program administrators is essential to determine your area’s specific eligibility requirements. They can provide detailed information and guide you through participating in a PACE program.

Understanding PACE programs is an excellent step toward unlocking the potential of energy upgrades for homeowners.

Eligibility Criteria for PACE Programs

Let’s talk about the eligibility criteria for PACE programs. While the specific requirements may vary depending on the location and program, here are some standard eligibility criteria to consider:

1. Property Type: PACE programs typically apply to commercial, industrial, and non-profit properties, but some programs may also include residential properties. It’s essential to check if your property type is eligible for the program you’re interested in.

2. Property Ownership: Generally, property owners are eligible for PACE programs. If you’re a tenant, you may need permission from the property owner to participate in the program.

3. Property Assessment: The property must be able to undergo an assessment to determine the potential energy savings and the cost of the upgrades. This assessment helps determine the amount of financing you can receive.

4. Local Program Requirements: Each PACE program may have additional eligibility criteria specific to that program. These criteria could include minimum project costs, creditworthiness, and compliance with local building codes.

It’s important to research and contact the specific PACE program in your area to get accurate and up-to-date information on eligibility requirements. They will be able to provide you with the most relevant details based on your location and property type.

Critical Components of PACE Programs

In PACE programs, the value of energy upgrades is determined through an assessment process. This involves evaluating the projected energy savings and the estimated cost of the upgrades. Qualified assessors or contractors typically conduct energy audits to assess the potential benefits of the proposed improvements. The assessed value is then used to calculate the financing amount that can be covered through the property tax assessment.

Under PACE programs, financing is secured through property taxes. Once the energy upgrades are completed, the property owner enters a financing agreement with the PACE program administrator. The administrator then places a special assessment on the property, which is added to the property tax bill. This assessment is used to repay the financing over a specified period, typically 10 to 20 years.

Repayment terms and schedules under PACE programs vary depending on the specific program and agreement. Generally, the repayment terms are designed to align with the expected useful life of the improvements. The repayment amount is typically collected as part of the property tax bill and is spread out over the agreed-upon term. It’s important to note that the assessment is attached to the property, so if it is sold, the repayment obligation transfers to the new owner.

Understanding the assessment process, financing structure, and repayment terms is essential when considering participation in PACE programs.

Advantages of PACE Programs

One significant advantage of PACE programs is the cost-effectiveness of financing through property taxes. Spreading the repayment over a longer term means property owners can avoid upfront costs and enjoy more manageable payments. Additionally, the interest rates for PACE financing are often competitive, making it an attractive option for funding energy upgrades.

PACE programs can lead to significant long-term savings. By investing in energy-efficient upgrades, property owners can reduce their energy consumption and lower utility bills. These savings can add up over time, helping offset the upgrades’ cost and improving the property’s overall financial outlook.

Another advantage of PACE programs is the potential to increase property value. Energy-efficient upgrades make a property more attractive to potential buyers or tenants and demonstrate a commitment to sustainability. This can result in higher property valuations and improved marketability in the long run.

PACE programs offer a compelling option for property owners looking to invest in energy efficiency by taking advantage of the financial benefits, long-term savings, and increased property value.

PACE programs give homeowners access to affordable financing for energy upgrades, allowing them to spread out the cost over time and save money on utility bills. By making energy-efficient upgrades, homeowners can enhance the value of their property, making it more attractive to potential buyers. PACE programs offer flexibility in project selection and allow for transferring the remaining balance to new property owners if the property is sold.

Homeowners should consider PACE an option for financing energy upgrades because it offers a win-win situation. You get to enjoy the immediate benefits of energy efficiency, such as lower utility bills and increased comfort, and contribute to a more sustainable future by reducing your carbon footprint.

PACE programs are vital in promoting energy efficiency and sustainability in homes. By providing accessible financing options, they empower homeowners to make impactful upgrades that benefit their wallets and the environment. These programs are paving the way for a greener and more sustainable future.

If you’re considering energy upgrades for your home, it’s highly recommended that you explore PACE programs as a financing option. They can help you achieve your goals while positively impacting your finances and the planet.