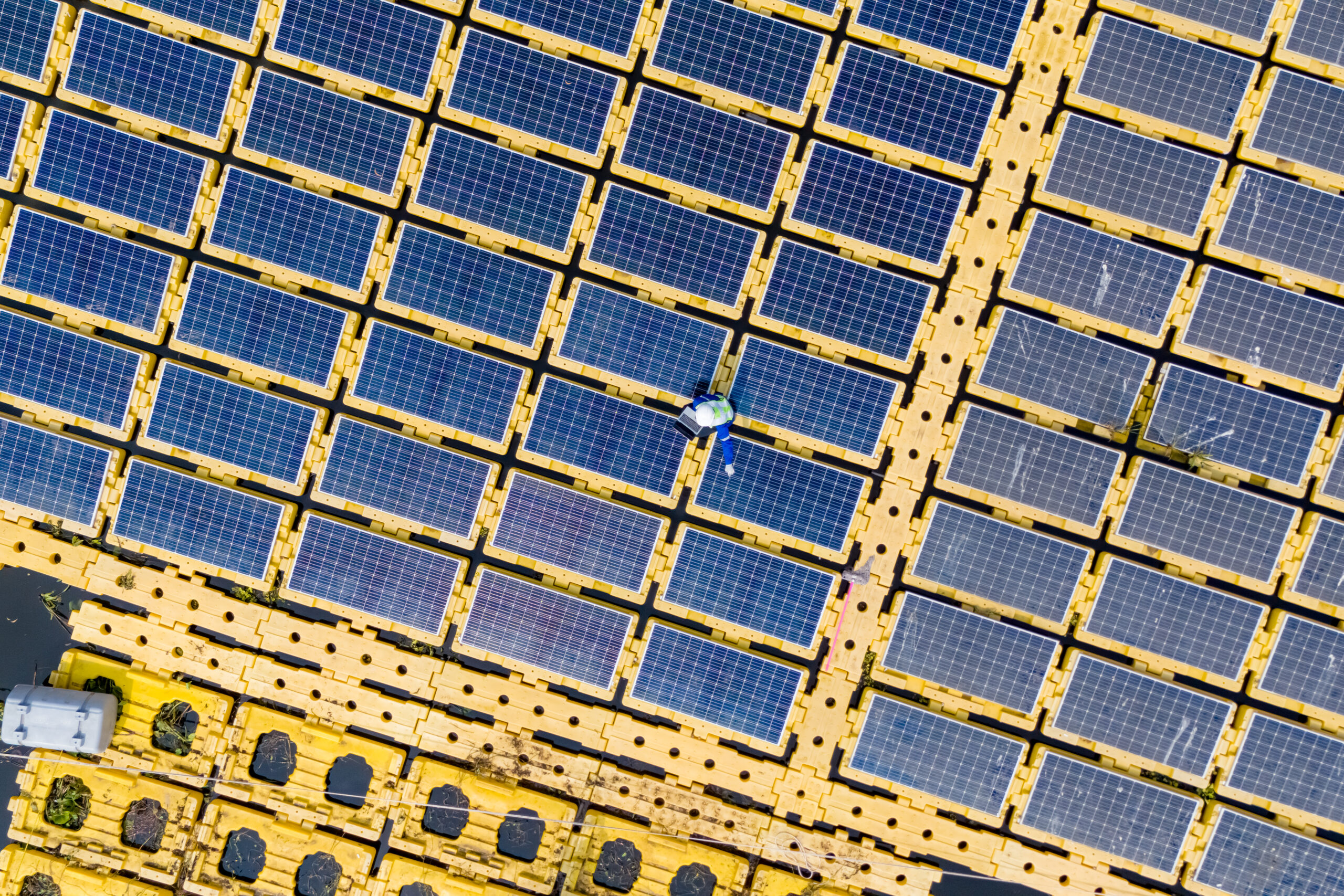

Solar energy is gaining momentum in Canada as a sustainable and eco-friendly alternative to traditional energy sources. With a growing awareness of the importance of renewable energy, the Canadian government has introduced various incentives to encourage the adoption of solar power. Among these incentives stands the 30% Solar Tax Credit, a key component of Canada’s renewable energy strategy. The 30% tax credit plays a crucial role in alleviating the financial burden associated with solar installations, promoting the widespread use of solar energy and fostering environmentally conscious practices nationwide.

The 30% Solar Tax Credit in Canada is a significant incentive designed to promote the adoption of solar energy by providing financial relief to individuals and businesses investing in solar power systems. This tax credit allows eligible taxpayers to deduct 30% of the cost of installing a solar energy system from their federal taxes, making solar energy more accessible and affordable.

Historically, the Solar Tax Credit was introduced in Canada to address the growing need for sustainable energy solutions and to reduce the country’s reliance on fossil fuels. It was implemented as part of the government’s broader environmental policies to mitigate climate change, reduce greenhouse gas emissions, and transition towards a cleaner and greener energy landscape.

The Solar Tax Credit’s importance extends beyond individual financial benefits. It plays a crucial role in the broader context of environmental policies by incentivizing the transition to renewable energy sources. By encouraging the use of solar power through financial incentives, the tax credit contributes to Canada’s commitment to reducing its carbon footprint, promoting sustainability, and fostering a greener future for future generations.

Both residential and commercial properties must meet a certain criteria to qualify for the 30% solar tax credit in Canada. Residential properties that install solar energy systems for personal use and commercial properties that integrate solar power into their operations are eligible for the tax credit.

Specific eligibility requirements include the installation of approved solar systems such as solar panels, solar water heaters, and solar energy storage systems. These systems must meet installation standards set by relevant authorities to ensure safety and efficiency. Documentation such as receipts, invoices, and installation certification is typically required to claim the tax credit.

For example, a homeowner who installs a solar panel system on their roof to generate electricity for personal use would likely qualify for the tax credit. On the other hand, a commercial property that installs solar panels for a parking lot lighting system may also be eligible. However, scenarios where solar systems are used for non-energy-related purposes or do not meet installation standards may be deemed ineligible for the tax credit.

Understanding how the 30% Solar Tax Credit works financially is crucial for individuals and businesses investing in solar energy. The tax credit is calculated based on 30% of the total cost of the solar energy system, including installation. For example, if a homeowner spends $20,000 on a solar panel system, they could receive a tax credit of $6,000 (30% of $20,000).

The financial impact of this tax credit offers both immediate and long-term benefits. Initially, the tax credit helps reduce upfront costs, making solar energy more affordable for consumers. Over the long term, the financial benefits are seen through savings on electricity bills and the return on investment from generating clean energy.

When comparing the 30% Solar Tax Credit with other financial incentives, such as rebates and grants, it’s important to note how they complement or differ. While the tax credit directly reduces the taxes owed, rebates typically provide a direct cash incentive after installing a solar system. Conversely, grants are funds awarded to support specific projects and may have different application processes.

Individuals and businesses need to follow a step-by-step process to apply for the 30% Solar Tax Credit. First, they must fill out the necessary forms provided by the Canada Revenue Agency (CRA). These forms typically include details about the solar energy system installation, the total cost, and other relevant information. Along with the forms, submitting documentation such as invoices, receipts, and proof of certification is crucial to supporting the application.

Common challenges during the application process may include incomplete forms, missing documentation, or errors in the information provided. To overcome these challenges, it’s recommended to double-check all forms for accuracy, ensure all required documents are included, and seek assistance from tax professionals if needed. Staying organized and maintaining clear records can help streamline the application process.

The timeline for approval and receiving the tax credit can vary. Once the application is submitted, the CRA typically reviews the information and processes the credit accordingly. The duration from application to benefit realization can range from a few weeks to a few months, depending on the volume of applications and the case’s complexity. It’s essential to be patient during this period and follow up with the CRA if there are any delays.

The Solar Tax Credit plays a significant role in contributing to environmental sustainability by promoting the adoption of clean energy. By incentivizing the installation of solar energy systems, the tax credit helps reduce the reliance on fossil fuels, thus lowering carbon emissions and mitigating climate change. This initiative aids in building a greener future and reducing the overall carbon footprint of individuals and businesses.

The tax credit fosters job creation in the renewable energy sector by encouraging investment in solar energy. Additionally, homeowners and businesses installing solar panels can enjoy long-term savings on electricity bills, as they generate clean energy and reduce reliance on traditional power sources. This financial incentive contributes to a more sustainable and cost-effective energy landscape.

Beyond environmental and economic advantages, the Solar Tax Credit promotes societal benefits by encouraging sustainable practices and community engagement in solar energy adoption. By making solar energy more accessible and affordable, the tax credit empowers individuals to transition actively towards renewable energy sources. This collective effort fosters a sense of environmental responsibility and community involvement in promoting a cleaner and more sustainable future for all.

The implementation of the Solar Tax Credit has had a notable impact on solar adoption rates. Statistical data reveals a substantial increase in solar installations across the country following the introduction of the tax credit. The number of residential and commercial properties adopting solar energy systems has surged, leading to a significant rise in renewable energy production. This surge in solar installations has contributed to a greener energy mix and played a crucial role in reducing greenhouse gas emissions and promoting sustainable energy practices nationwide.

The future of the Solar Tax Credit in Canada may see potential changes or extensions based on government plans and policy directions. Authorities are considering enhancing the tax credit to further incentivize solar energy adoption and accelerate the transition to renewable energy sources. Extending the tax credit period, increasing incentive rates, or expanding eligibility criteria are among the possible adjustments being discussed to promote sustainable energy practices.

Predictions for the solar industry’s growth in Canada indicate a significant upward trajectory. With advancements in solar technology, decreasing installation costs, and the continued support of initiatives like the Solar Tax Credit, the adoption of solar energy is expected to soar. More residential, commercial, and industrial properties are projected to embrace solar solutions, substantially increasing solar installations and renewable energy production nationwide.